Protect Yourself from Fraud

Stay alert to the latest scams and take steps to safeguard your financial well-being. If you notice anything unusual, trust your instincts and act quickly.

Fraudsters can impersonate banks by phone, text, email, or online ads, attempting to obtain your personal or financial details. Review our Red Flag checklist below to recognize common warning signs and enhance your security. Review the different types of scams and fraud with our resources on this page to help you identify scams and know how to respond, whether for yourself or to support someone you know. Remember, fraud can target anyone.

If you have questions or need immediate assistance, please contact us directly. Our team is always here to help protect you and your information.

RED FLAGS TO WATCH OUT FOR! Question anything that doesn't feel right before it costs you everything.

Scroll down to read about current and common scams.

Unsolicited Contact?

Did you receive a call, text, or email unexpectedly from someone claiming to represent Martha's Vineyard Bank?

Urgent Requests?

Are you being pressured to act quickly due to you or someone being in legal or financial trouble?

Unfamiliar Sources?

Did you receive a message from an unknown source not associated with Martha's Vineyard Bank?

Common

Scams

Warning signs

for common scams

Common Scams

- How Scammers Tell You to Pay - Scammers often say you've won a prize, you owe a debt, or a family member is in an emergency. READ ARTICLE

- Social Security Scams - Scammers pretend to be calling from Social Security and aim to get you to tell them your social security number. READ ARTICLE

- Phishing Scams - Scammers send emails or text messages to fool you into giving them your personal information. READ ARTICLE

- IRS Scams - Scammers pretend to be calling from the IRS, and say they're filing a lawsuit against you for owed taxes. READ ARTICLE

- Fake Check Scams - Scammers ask you to deposit a check for more than the owed amount and send some of the money to another person. READ ARTICLE

How to

Avoid Fraud

Take ten simple steps

to protect yourself.

HOW TO AVOID FRAUDTen Things You Can Do

- Spot imposters - Scammers often pretend to be someone you trust, like a government official, a family member, or a charity.

- Do online searches - Type a company or product name into your favorite search engine with words like "review," "complaint" or "scam."

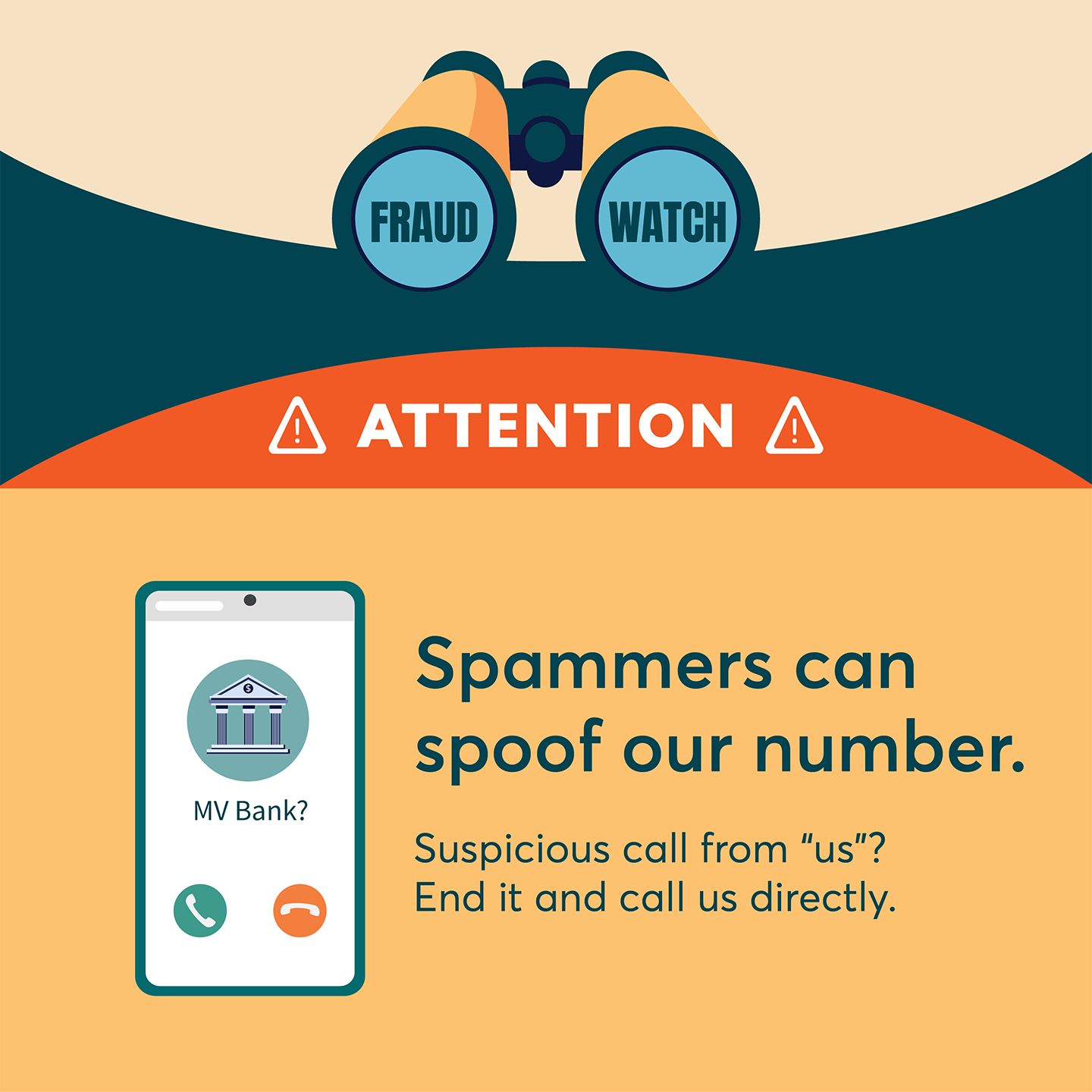

- Don't believe your caller ID - Technology makes it easy for scammers to fake caller ID information, so the name and number you see aren't always real.

- Don't pay upfront for a promise - For things like debt relief, credit and loan offers, mortgage assistance, a job, or a prize.

- Consider how you pay - Credit cards have significant fraud protection built in, but some payment methods don't.

- Talk to someone you trust - Before you give up your money or personal information.

- Hang up on robocalls - Hang up and report it to the FTC.

- Be skeptical about free trial offers - Research the company.

- Don't deposit a check and wire money back - If a check you deposit turns out to be a fake, you're responsible for repaying the bank.

- Sign up for free scam alerts from the FTC at ftc.gov/scams.

Outsmart

Scammers

There are things that

banks never ask

Outsmart The ScammersHow to identify fraud. (Things Banks Never Ask.)

- Banks will never ask for your password or pin number in a text message.

- Banks will never ask you to click a suspicious link or provide confidential info in an email.

- Banks will never ask you to verify your pin over the phone.

- Banks will never ask for the following in an email, text, or phone call for any of the following:

- Your account number

- Your user name or password

- Your Social Security Number

- Your Pin

- Your Birthday

- Your Address

- Share a One-Time Code

- Fill Out a Form

- Download an Attachment

- Reveal a Security Question Answer

Any of the above is a definite RED FLAG. End the call, delete the text, or trash the email.

Pro Tips

- Look for misspelled words

- Call the phone number on your card

- Protect your confidential info

- Beware of scare tactics

- Beware of links

Protecting

Our Elders

Look out for each other

Help the vulnerable.

Protecting Our Elders:

Having a conversation with the seniors in your life about common scams and staying involved in their lives is a great way to start. Check out this link for some more great info on how to help protect our seniors from scams and fraud:

Protecting

Veterans

Recognize fraud attempts common to veterans.

Protecting Our Veterans

During the past four years, the FTC has logged more than 378,000 reports from veterans - and nearly 161,000 were fraud-related.

Contact UsManage Your

Security

Customize your alerts

Set your privacy choices.

Manage Your Security

Set transaction limits, location limits, and merchant limits for your debit card right on your smartphone using our mobile App. Watch a tutorial on how to download the App and how to set card limits. It's easy and a wise thing to do in these stressful times.

Think you left your debit card behind and want to instantly block it so no new transactions can be made? No problem. You can do this with one click right from your smartphone.

Download our App today!

FTC Online

Resources

Resources for keeping you and your personal information safe.

Online Resources

Identity Theft

Support

Immediate action is the key.

Identity Theft

If you suspect that you are a victim of identity theft, please CONTACT THE BANK IMMEDIATELY!

After that, visit www.IdentityTheft.gov. It's the federal government's one-stop resource for identity theft victims. The site provides step-by-step guidance, streamlined checklists and sample letters to guide you through the recovery process. If you prefer, you can download the entire kit, or ask a Martha's Vineyard Bank Customer Service Representative to print it for you.

Contact UsStay informed. Be smart.

The best defense against falling victim to scams and fraudulent financial activity is to stay abreast of common scams making the news and to use common sense. If something doesn't seem right to you, it probably isn't. Trust your instincts.The Martha's Vineyard Bank Fraud Prevention Page is intended to help educate you and provide resources for avoiding scams and how to move forward if you or someone you know becomes a victim. Anyone is susceptible. Scammers are clever and tend to prey on our heartstrings to get personal information. Please call us anytime for help. We're here for you.